A No-Nonsense Look at Market Trends

The Houston Housing Market: Where Do We Stand in Summer 2025?

The Houston real estate market has always marched to its own beat. While national headlines scream about crashes or booms, H-Town typically follows a more measured path. So where do we stand right now? Let’s cut through the noise and look at what’s actually happening on the ground in Greater Houston this summer.

The numbers tell an interesting story: median home prices are currently hovering around $313,936, showing a modest 1.6% decrease compared to this time last year. This represents a cooling trend rather than a dramatic shift. While some neighborhoods are seeing price adjustments, others remain surprisingly resilient—particularly master-planned communities and areas with strong school districts.

For Sellers: Is It Time to List?

If you’ve been waiting for the “perfect moment” to sell, you might want to pay attention. Current inventory levels are at a 13-year high, which means competition is increasing. Each month that passes brings more homes to the market, potentially diluting your property’s visibility.

“The days of multiple offers within hours of listing are largely behind us,” explains Bill Bexley, CEO of Bexley Realty Group. “Today’s successful sellers understand the importance of strategic pricing and presentation. The market is normalizing, not crashing.”

The Case for Selling Now:

- Seasonal Advantage: Summer remains a prime selling season in Houston, with families looking to settle before the new school year.

- Still-Healthy Prices: Despite minor adjustments, home values remain significantly higher than pre-pandemic levels. Most homeowners who purchased before 2021 still have substantial equity.

- Interest Rate Uncertainty: While rates have stabilized somewhat, economic indicators suggest potential fluctuations ahead. Waiting could mean your potential buyer pool faces higher borrowing costs.

- Rising Inventory: The market is trending toward balance. Current data shows available homes have increased by approximately 18% compared to last year, creating more competition among sellers.

Our recent market analysis shows homes in desirable areas like The Woodlands, Katy, and parts of the Inner Loop still move quickly—averaging 29 days on market—when priced appropriately. However, properties requiring significant updates or priced aggressively now sit longer than they would have just 18 months ago.

For Buyers: Opportunity Knocks?

If you’re considering purchasing in Greater Houston, there’s good news. The market has shifted from the frenzied seller’s market of 2021-2023 to something more balanced. This doesn’t mean a buyer’s market across the board, but it does mean you have more options and potentially more negotiating power.

Why Consider Buying Now:

- Increased Selection: With inventory at 13-year highs, buyers have more choices than at any point since 2012. This allows for more thoughtful decisions rather than panic buying.

- Price Stabilization: While still strong, prices have moderated. Forecasts suggest modest adjustments continuing (potentially -0.7% by August), rather than dramatic drops or increases.

- Relocation Advantage: If you’re moving from higher-priced markets like California, New York, or even Austin, your purchasing power stretches significantly further in Houston.

- New Construction Options: Building permits have increased approximately 20% year-over-year, creating fresh inventory in many desirable suburbs.

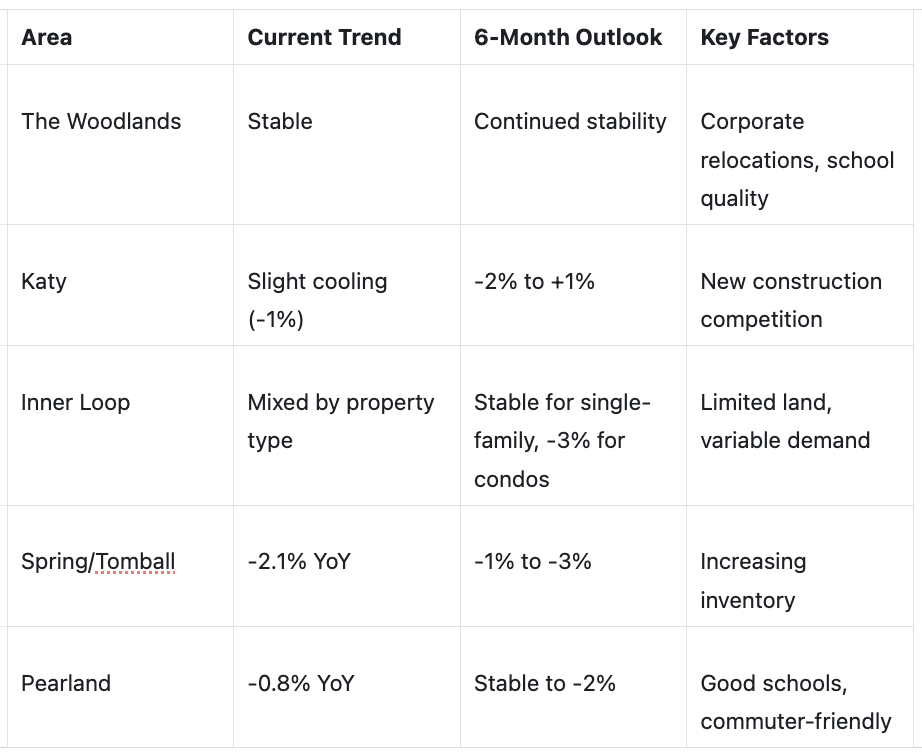

Houston’s Hyper-Local Markets: Where to Focus

One of Houston’s defining characteristics is its diversity of submarkets. While overall trends provide guidance, smart buyers and sellers need to understand neighborhood-specific dynamics:

The Woodlands & North Houston

This area continues to outperform broader market trends, with stable prices and strong demand fueled by corporate relocations and excellent schools. Property tax advantages in Montgomery County further enhance appeal for buyers coming from out of state.

Katy & West Houston

New construction continues at a rapid pace, creating competition for resale homes. However, family-friendly amenities and highly-rated school districts keep demand steady. Homes priced under $450,000 in good condition still move quickly.

Inner Loop

The closest thing to a “recession-proof” Houston market, though not immune to broader trends. Townhome inventory has increased significantly, creating buying opportunities in areas like The Heights and Montrose that rarely experienced slowdowns previously.

Southeast/Clear Lake

NASA and healthcare jobs provide stability, while recent infrastructure improvements have enhanced appeal. This area offers some of the best value propositions for first-time buyers seeking established neighborhoods.

“Houston’s resilience comes from its economic diversity. While energy remains important, healthcare, technology, manufacturing, and logistics have created a buffer against sector-specific downturns.” – Houston Association of REALTORS® (HAR)

Interest Rates: The X-Factor

No discussion of today’s market would be complete without addressing interest rates. After reaching multi-decade highs in late 2023, mortgage rates have moderated somewhat but remain significantly higher than the 3% range seen in 2020-2021.

Current 30-year fixed rates averaging around 6.2% have impacted affordability, particularly for first-time buyers. However, this has been partially offset in Houston by moderate price adjustments and increased seller concessions.

Buyers should note that while today’s rates seem high compared to the pandemic era, they remain lower than historical averages from the 1980s through early 2000s. More importantly, there’s evidence of buyers adapting:

- Increased interest in adjustable-rate mortgages (ARMs)

- Growing popularity of 2-1 buydown options where sellers contribute to temporarily lower rates

- Rising use of assumable VA and FHA loans where possible

Market Predictions: The Next Six Months

Based on current data and seasonal patterns, here’s what we expect for the remainder of 2025:

- Continued Inventory Growth: Supply levels will likely peak in late summer/early fall before seasonal declines. This favors buyers who can act during this window.

- Modest Price Adjustments: Most neighborhoods will see continued stabilization rather than dramatic shifts in either direction. Overall, the Greater Houston market may experience a 1-2% decline through year-end, but with significant neighborhood variation.

- Increasing Price Sensitivity: Properly priced homes will still sell within 30-45 days in most areas. Overpriced listings will face longer market times and potential stigma.

- Seasonal Slowdown: The typical fall/winter decrease in activity will be more pronounced this year, creating both challenges for sellers and opportunities for motivated buyers during the holiday season

Regional Price Forecast Comparison

The Bottom Line: Should You Buy or Sell?

For Sellers:

If you’re considering selling in the next 12 months, sooner is likely better than later. Current conditions still favor well-prepared, appropriately priced homes. The combination of rising inventory and seasonal patterns suggests waiting carries increasing risk.

Sellers should focus on:

- Realistic pricing based on recent comparables, not 2022 peak values

- Professional presentation and marketing

- Flexibility on terms, including potential seller concessions

- Quick responses to offers, as buyers have more options

For Buyers:

The market has shifted in your favor compared to recent years, but don’t expect dramatic discounts in most areas. The advantage comes in selection, time to decide, and negotiating power rather than rock-bottom prices.

Buyers should:

- Get fully pre-approved before shopping

- Consider properties that have been listed 30+ days, where sellers may be more flexible

- Explore neighborhoods where inventory is highest

- Remain decisive on well-priced properties in desirable areas, as they still move quickly

Final Thoughts

The Houston market is normalizing, not crashing. For most participants, this represents a healthier, more sustainable environment than the frenzy of 2021-2022. The key is understanding your specific situation and how it aligns with current conditions.

Whether you’re buying or selling, working with a knowledgeable real estate professional who understands Houston’s hyper-local nature is more important than ever. At Bexley Realty Group, we’re committed to providing that neighborhood-specific expertise to help you navigate today’s evolving market.

Want to discuss your specific situation? Contact us at 832-816-5139 for a personalized market analysis of your property or buying needs.