Source: https://www.har.com/content/department/newsroom?pid=1983

Amid another sales decline, inventory grows and prices continue to moderate

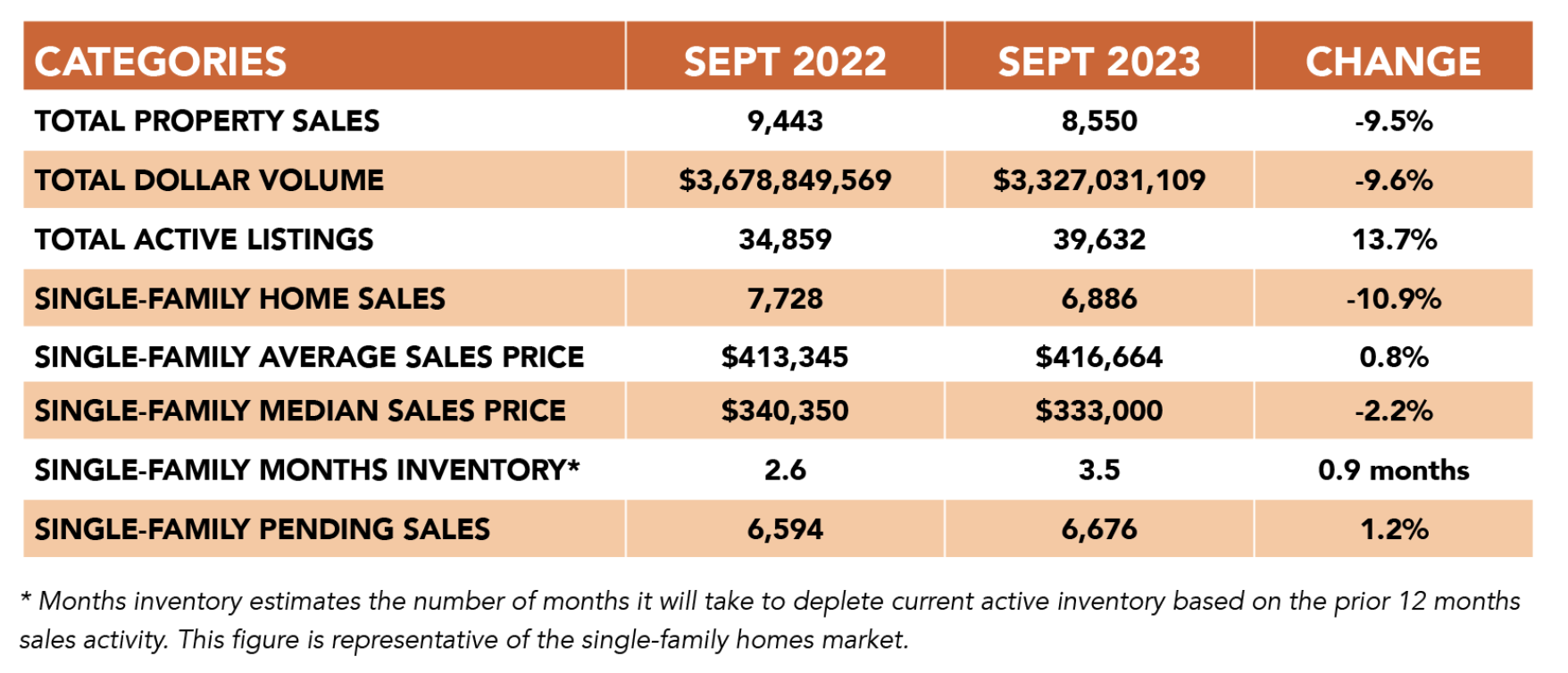

HOUSTON — (October 11, 2023) — Houston home sales were down for an 18th consecutive month in September as interest rates continued to keep prospective homebuyers headed toward the rental market or putting their buying plans on hold. The slower sales volume enabled inventory to expand and prices to moderate, creating more buyer-friendly conditions once consumer confidence is restored.

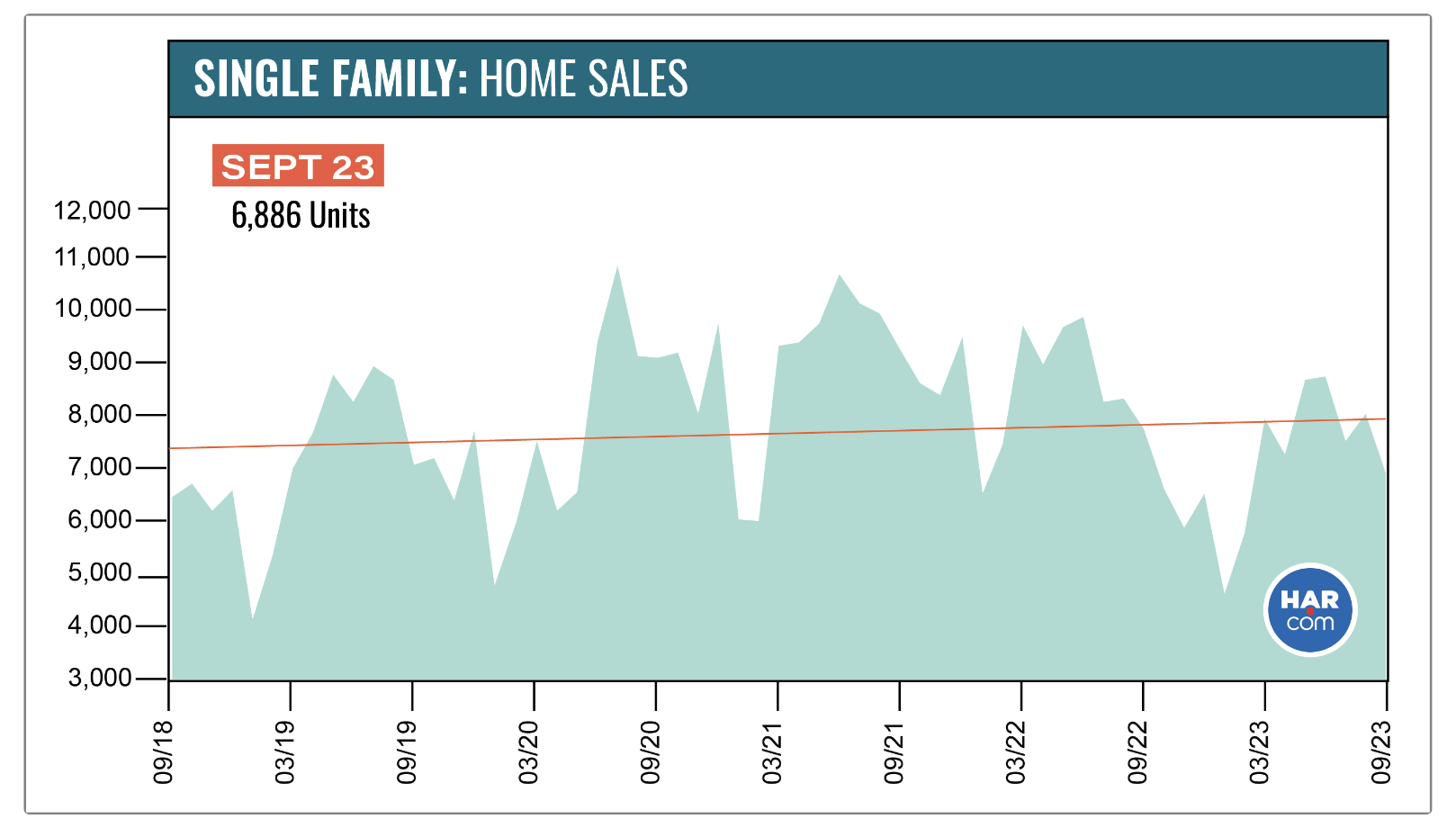

According to the Houston Association of Realtors’ (HAR) September 2023 Market Update, single-family home sales across the market fell 10.9 percent year-over-year with 6,886 units sold compared to 7,728 in September 2022. Months supply of homes climbed to 3.5, the highest level since November 2019 when it was at a 3.6-months supply. Compared to pre-pandemic September 2019, when volume totaled 7,050, home sales were down 2.3 percent.

All housing segments experienced declines except for the sub-$100,000 market, which contains only 1.2 percent of Houston’s overall housing inventory. It was statistically flat. Rentals of single-family homes and townhomes/condominiums remained strong. HAR will publish its September 2023 Rental Home Update next Wednesday, October 18.

“September was a rather lackluster month on the sale side of Houston real estate, and with the holidays approaching, we probably won’t see much improvement as this is traditionally a slow time of year for our industry,” said HAR Chair Cathy Treviño with LPT, Realty. “Rental homes continue to draw strong interest from consumers and it will be interesting to see if that flourishes throughout the holiday season as would-be buyers remain skittish over mortgage rates.”

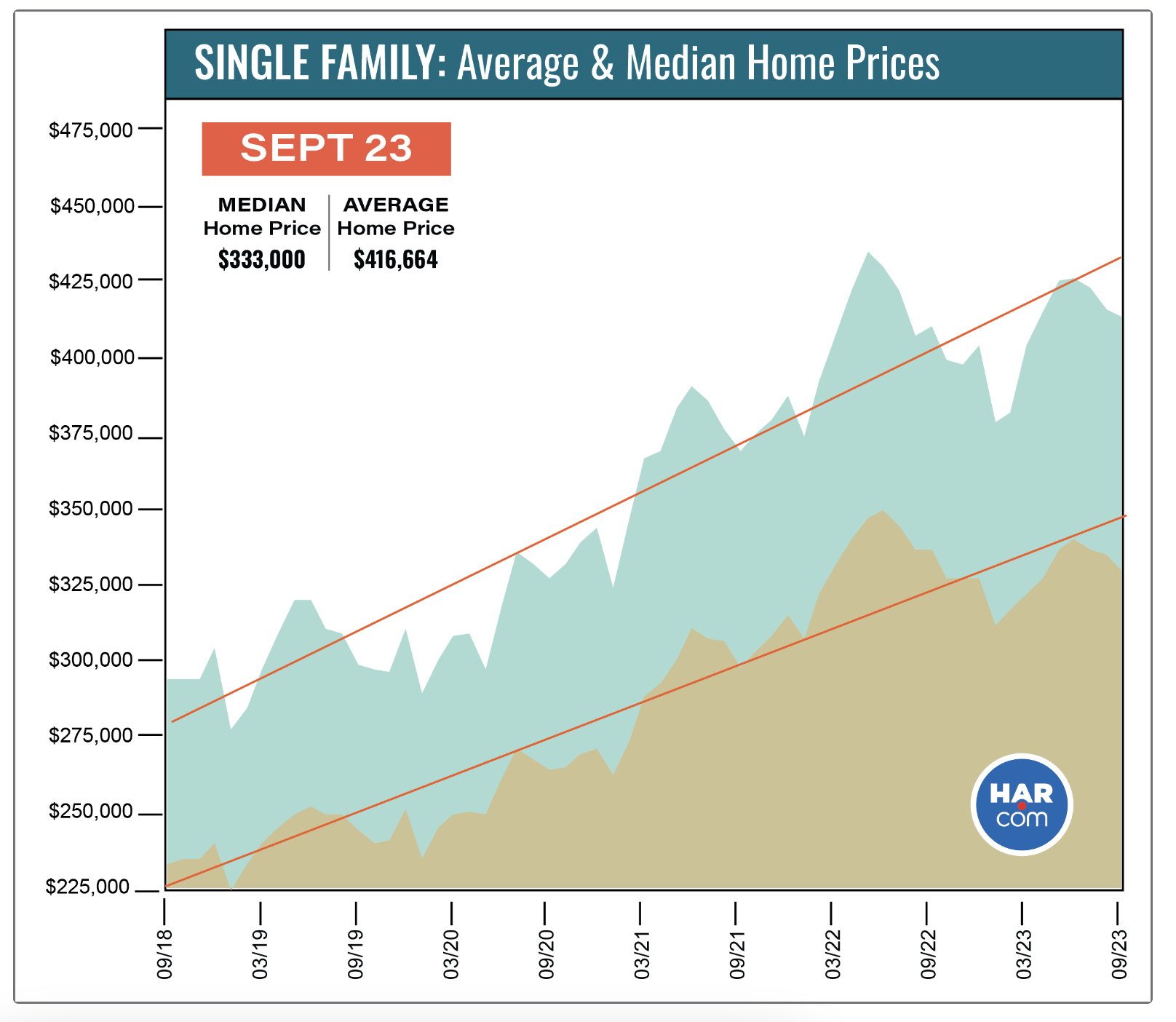

Single-family home prices continue to moderate. The average price edged up just 0.8 percent to $416,664 while the median price fell 2.2 percent to $333,000. Those figures are well below the record highs of $438,350 (average) in May 2022 and $354,000 (median) in June 2022.

September Monthly Market Comparison

September was the 18th straight month of negative sales activity with year-over-year single-family home sales falling 10.9 percent. When compared to pre-pandemic September 2019, sales were down 2.3 percent and when stacked against the sales volume in September 2018, five years ago, sales were up 7.1 percent.

In addition to the decline in single-family sales volume, total property sales and total dollar volume also fell below last year’s levels. Total dollar volume was $3.3 billion, down from $3.7 billion a year earlier. Single-family pending sales rose 1.2 percent. Active listings, or the total number of available properties, were 13.7 percent ahead of the 2022 level.

Months of inventory expanded in September to a 3.5-months supply. That is the greatest months supply since November 2019 when it was at a 3.6-months supply. Housing inventory nationally is at a 3.3-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-months supply is generally regarded as representing a “balanced market” in which neither buyer nor seller has an advantage.

Single-Family Homes Update

Single-family home sales fell 10.9 percent year-over-year in September with 6,886 units sold across the Greater Houston area compared to 7,728 in 2022. Pricing continues to ease after rising to record highs last spring. The September average price rose a fractional 0.8 percent to $416,664 while the median price fell 2.2 percent to $333,000.

For a pre-pandemic perspective, September closings were 2.3 percent below September 2019’s total of 7,050. The September 2023 median price of $333,000 is 36.1 percent higher than it was in 2019 ($244,679) and today’s average price of $416,664 is 39.1 percent higher than it was then ($299,600). Sales are 7.1 percent above where they were five years ago, in September 2018, when volume totaled 6,427. Back then, the median price was $232,990 and the average price was $294,656.

Days on Market, or the actual time it took to sell a home, increased from 37 to 45 days. Months of inventory registered a 3.5-months supply compared to 2.6 months a year earlier. The current national supply stands at 3.3 months, as reported by NAR.

Broken out by housing segment, September sales performed as follows:

- $1 – $99,999: was unchanged

- $100,000 – $149,999: decreased 8.6 percent

- $150,000 – $249,999: decreased 8.0 percent

- $250,000 – $499,999: decreased 11.5 percent

- $500,000 – $999,999: decreased 9.9 percent

- $1M and above: decreased 4.5 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 5,054 in September, down 15.2 percent from the same month last year. The average price rose 2.5 percent to $418,649 and the median sales price declined 1.2 percent to $325,000.

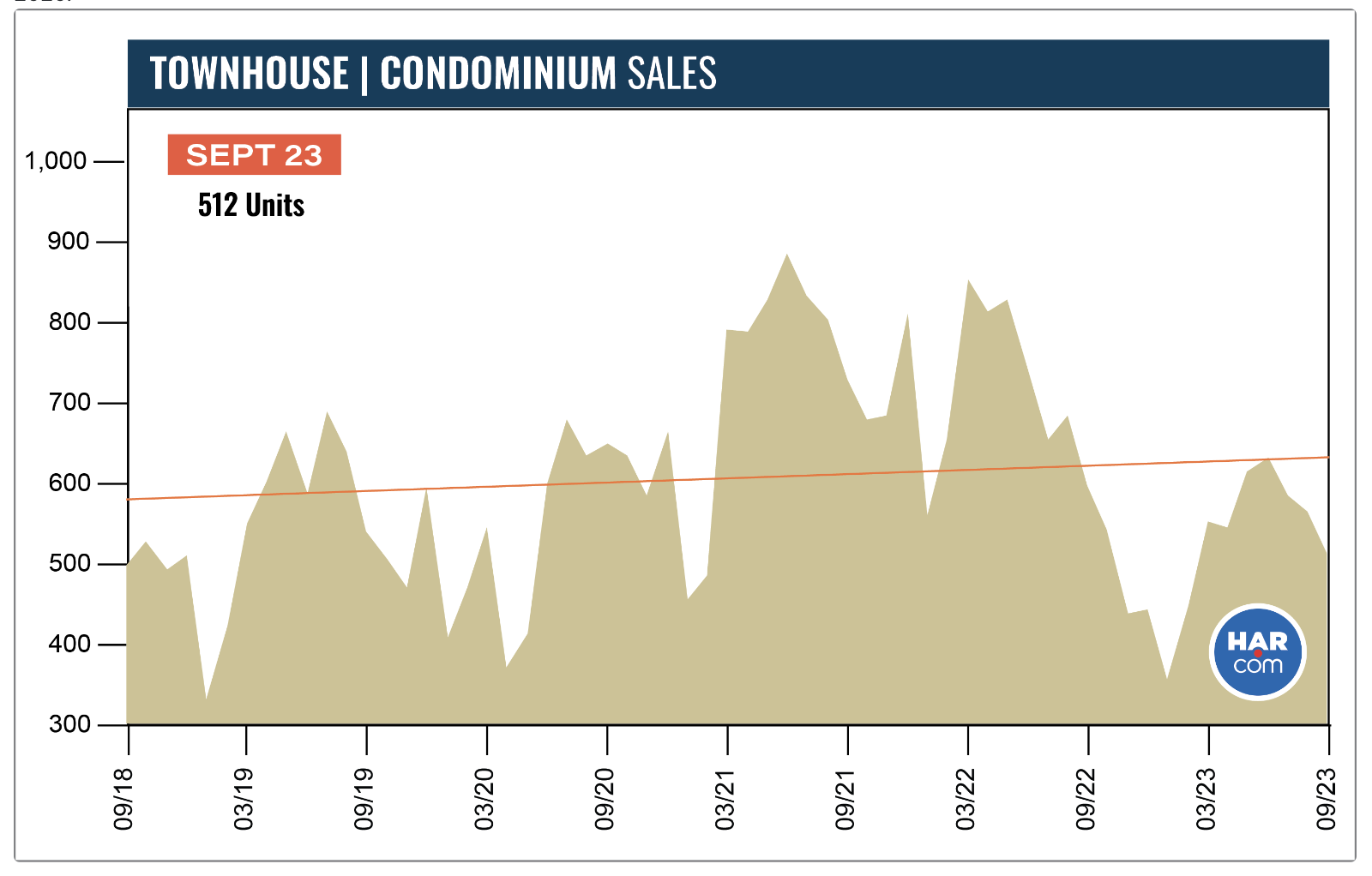

Townhouse/Condominium Update

Townhouses and condominiums experienced their 16th straight monthly decline in September, dropping 14.4 percent year-over-year with 512 closed sales versus 598 a year earlier. The average price was statistically flat at $257,909 and the median price edged up 2.2 percent to $224,250. Inventory grew from a 2.0-months supply to 3.5 months, the highest level since November 2020.

Compared to pre-pandemic September 2019, when 540 units sold, townhome and condominium sales were down 5.2 percent. The average price back then, at $200,246, was 22.4 percent lower and the median price, at $170,000 was 24.2 percent lower.

Houston Real Estate Highlights in September

- Single-family home sales fell 10.9 percent year-over-year, making September the 18th consecutive month of slowing sales volume;

- Compared to September 2019, before the pandemic, sales were down 2.3 percent, and compared to September 2018, five years back, they were up 7.1 percent;

- Days on Market (DOM) for single-family homes rose from 37 to 45 days;

- Total property sales fell 9.5 percent with 8,550 units sold;

- Total dollar volume dropped 9.6 percent to $3.3 billion;

- The single-family median price fell 2.2 percent to $333,000;

- The single-family average price rose 0.8 percent to $416,664;

- Single-family home months of inventory registered a 3.5-months supply, up from 2.6 months a year earlier – the biggest supply since November 2019;

- Townhome/condominium sales experienced their 16th straight monthly decline, falling 14.4 percent, with the median price up 2.2 percent to $224,250 and the average price up 0.3 percent to $257,909;

- Compared to pre-pandemic 2019, townhome and condominium sales were down 5.2 percent.