Are Big Warehouses Dead? How Houston's Commercial Real Estate Shift Creates New Opportunities for Entrepreneurs

The short answer? Big warehouses in Houston aren’t dead: but they’re definitely on life support. What we’re seeing is a massive market correction that’s creating some of the best opportunities for entrepreneurs in years. If you know where to look and how to play your cards right, this shift could be the break your business has been waiting for.

The Reality Check: What’s Really Happening

Houston’s industrial market is experiencing something we haven’t seen since 2016: a genuine oversupply problem. We’ve got about 19 million square feet of warehouse space under construction right now, with most buildings exceeding 100,000 square feet. Here’s the kicker: most of it is sitting empty, waiting for tenants.

Vacancy rates have climbed to 7.4% in Q3 2025, the highest we’ve seen in recent years. That might not sound dramatic, but in the industrial world, that’s a significant shift. For the first time since the pandemic boom, landlords are sweating, and tenants have real negotiating power.

The big-box segment: those massive 100,000+ square foot warehouses concentrated near Beltway 8 and the Port: is getting hit hardest. Concessions are up, rents are moderating, and landlords who used to have waiting lists are now rolling out the red carpet for potential tenants.

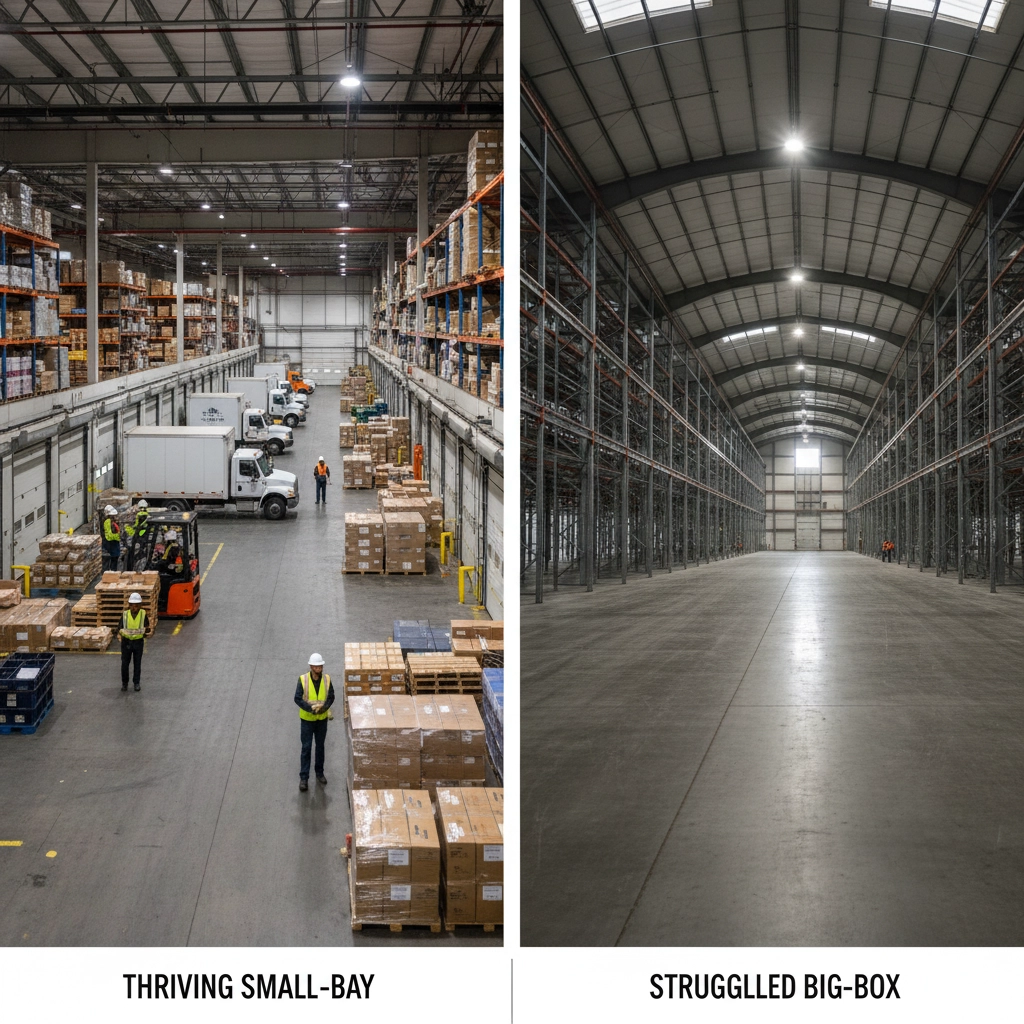

The Great Divide: Small vs. Big

Here’s where it gets interesting for entrepreneurs. While the mega-warehouses are struggling, small-bay and infill spaces are absolutely crushing it. Properties in the 5,000 to 50,000 square foot range continue to see strong demand with minimal new supply.

This creates a perfect storm of opportunity:

- Big spaces: Oversupplied, landlords desperate to fill them, great negotiating leverage

- Small spaces: Still competitive but proven demand, stable investment potential

- Mid-sized spaces: The sweet spot where smart operators are making moves

Average rents hit $10.52 per square foot (triple net) in Q3 2025: up 38% over the past five years. That growth is slowing down (just 1.8% year-over-year now), but it’s still growth. And in the small-bay segment, pricing power remains strong.

Manufacturing Renaissance: The Onshoring Wave

One of the biggest opportunities flying under the radar is manufacturing and onshoring. Manufacturing requirements surged in Q1 2025, driven by tariffs and companies bringing production back to America. We’re seeing deals like Midstream Valve Partners grabbing 173,544 square feet and Deugro taking 164,640 square feet in Baytown.

This isn’t just about big corporations. Mid-sized manufacturers, specialty producers, and even small-batch operations are looking for Houston space. The region’s energy expertise, port access, and skilled workforce make it a magnet for companies reshoring production.

Strategic Plays for Smart Entrepreneurs

1. The Landlord Leverage Play

With oversupply in big-box spaces, this is your moment to negotiate like a boss. Landlords are offering:

- Extended free rent periods

- Substantial tenant improvement allowances

- Flexible lease terms

- Below-market rates with built-in escalations

If your business can use 50,000+ square feet, you’re in the driver’s seat for the first time in years.

2. The Adaptive Reuse Opportunity

Big empty warehouses are perfect candidates for creative repurposing. Think:

- Multi-tenant flex facilities (subdivide and sublease)

- Cold storage operations (huge demand growth)

- High-tech manufacturing requiring large floor plates

- Event spaces and experiential retail

- Last-mile distribution hubs

3. The Logistics and E-commerce Angle

Houston’s position as a logistics hub isn’t going anywhere. The Northwest submarket absorbed nearly 400,000 square feet in Q1 2025, while the Northeast added over 300,000 square feet. E-commerce fulfillment, regional distribution, and third-party logistics services continue driving demand in strategic corridors.

4. The Infill Investment Strategy

Properties near population centers command premium pricing and stay occupied. These serve local contractors, small manufacturers, and service businesses that prioritize customer proximity over rock-bottom rents. Vacancy rates in quality infill locations remain well below market averages.

The Financing Window (It Won’t Last Forever)

Here’s the thing: this window of opportunity has an expiration date. Houston added 260,000 jobs post-pandemic and maintains steady employment growth. The underlying demand is real; we’re just working through a temporary supply glut.

Development activity is already slowing due to high construction costs and tighter lending standards. Once this excess inventory gets absorbed (likely 12-18 months), we’ll be back to a supply-constrained market with rising rents and limited options.

Where to Focus Your Search

Port-adjacent areas remain hot for import/export businesses and manufacturing requiring maritime access. Northwest and Northeast corridors offer the best balance of availability, accessibility, and future growth potential.

Energy Corridor and Westchase submarkets provide access to corporate headquarters and skilled workers. East Harris County offers the most competitive pricing with strong fundamentals.

Avoid submarkets with planned massive developments unless you’re getting an exceptional deal. Focus on areas where new supply is limited and existing inventory is mostly occupied.

The Bottom Line Strategy

The smart play isn’t avoiding big warehouses: it’s understanding where oversupply creates leverage and where scarcity maintains value. Progressive operators are securing oversized spaces at discounted rates with sublease flexibility, positioning for future demand when supply tightens.

Others are doubling down on small-bay properties where competition remains fierce and growth prospects solid. Both strategies can work, but success depends on execution, timing, and understanding your specific business needs.

Houston’s industrial market isn’t declining: it’s normalizing after explosive growth that expanded inventory nearly 20% over five years. For entrepreneurs ready to move decisively while landlords remain motivated, this represents the most favorable entry point in years.

Ready to Capitalize on Houston’s Commercial Real Estate Opportunities?

The warehouse market shift is creating once-in-a-decade opportunities, but they won’t last forever. Whether you’re looking to expand operations, relocate your business, or invest in commercial property, now is the time to act.

Contact Bexley Realty Group today at 832-648-2492 or visit BexleyRealtyGroup.com to discuss your commercial real estate strategy. Our team knows Houston’s industrial markets inside and out: we’ll help you identify the opportunities and negotiate the deals that position your business for long-term success.

Don’t wait for the market to tighten up again. The best deals are happening right now.

#HoustonCommercialRealEstate #WarehouseOpportunities #IndustrialRealEstate #BexleyRealtyGroup #EntrepreneurOpportunities #HoustonBusiness #CommercialProperty