Houston Real Estate Market Forecast: Where Are Home Prices Headed in Late 2025?

As we approach the final quarter of 2025, Houston’s real estate market is showing promising signs of recovery after a year of adjustment and stabilization. If you’re considering buying, selling, or investing in Houston real estate, understanding where home prices are headed in the coming months is crucial for making informed decisions.

Current State of the Houston Real Estate Market

The Houston-The Woodlands-Sugar Land metro area has experienced a dynamic year in 2025, with the market showing resilience despite national economic uncertainties. Currently, the average home value sits at approximately $313,936, representing about a 1.6% decrease from the previous year. However, this slight dip tells only part of the story.

What’s particularly noteworthy is the significant increase in inventory levels. Active listings have surged 31.8% year-over-year as of mid-2025, reaching record highs according to the Houston Association of Realtors. This inventory boom has created a more balanced market, giving buyers increased negotiating power while challenging sellers to price competitively.

Despite the inventory surge, sales activity has remained surprisingly robust. Single-family home sales increased 2.6% year-over-year in March 2025, with 7,429 units sold. This indicates that while buyers have more choices, demand remains steady: a healthy sign for market stability.

Price Projections for Late 2025

The Bottom Line: Modest Growth Ahead

After months of market analysis and expert predictions, the consensus points toward modest appreciation in Houston home values through the remainder of 2025. Industry experts predict nearly a 2% increase in home prices by year-end, marking a shift from the slight declines observed earlier in the year.

This projected growth is supported by several factors:

• Improved buyer confidence as mortgage rates show signs of stabilizing

• Continued population growth in the Greater Houston area

• Strong job market diversification beyond the traditional energy sector

• New construction activity meeting but not oversupplying demand

The median home price for single-family homes, which stood at $325,000 in February 2025, is expected to see gradual appreciation as we move toward 2026.

Mortgage Rates: The Game Changer

Interest rates will play a pivotal role in shaping Houston’s real estate landscape through late 2025. Currently averaging around 6.7% for 30-year loans, mortgage rates are predicted to average 6.4% in the second half of 2025.

This anticipated decline in rates could provide the catalyst needed to:

• Increase buyer purchasing power

• Stimulate refinancing activity

• Support price stabilization and growth

• Attract investors back to the market

For context, even a 0.3% decrease in mortgage rates can significantly impact monthly payments and overall affordability for Houston homebuyers.

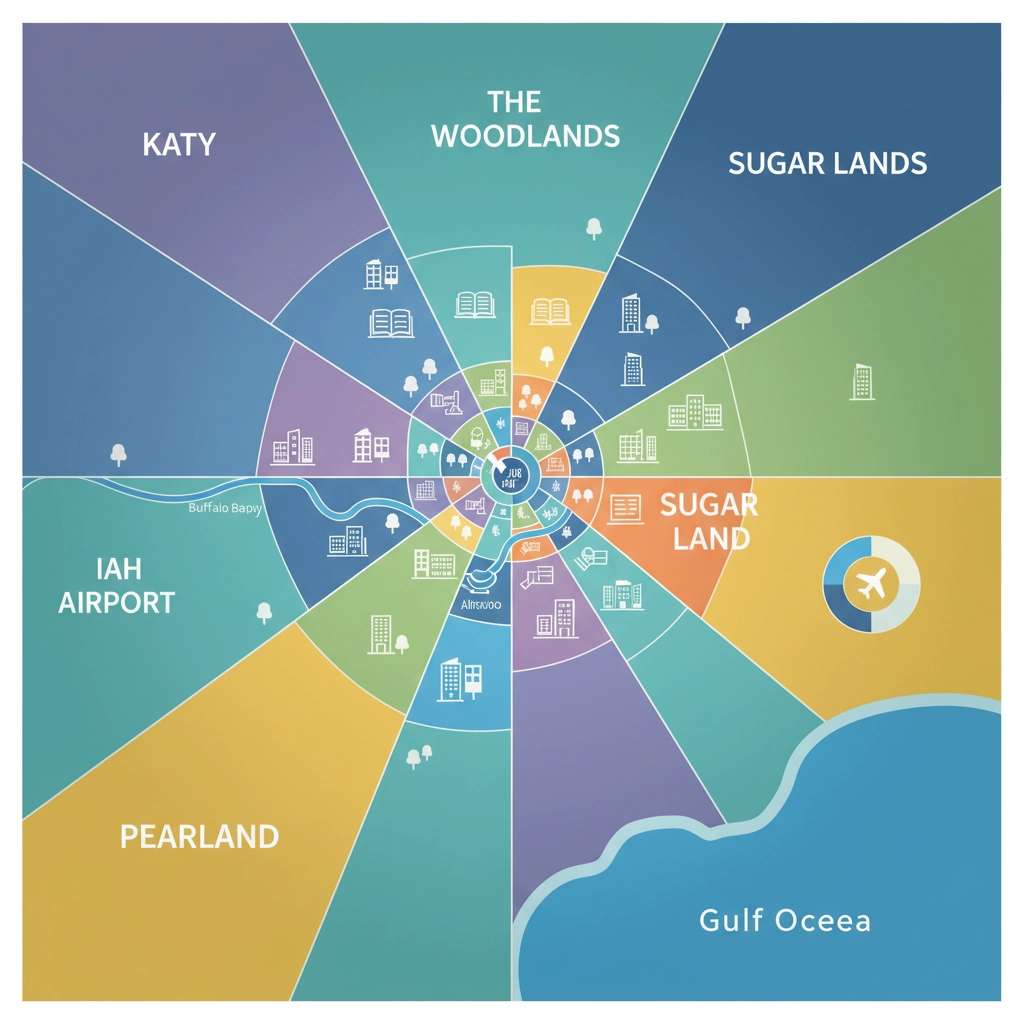

Neighborhood Spotlight: Where Growth is Expected

Not all Houston neighborhoods will experience uniform price growth in late 2025. Based on current trends and development patterns, here are the areas showing the strongest potential:

High-Growth Potential Areas:

• Katy and Fulshear – New master-planned communities and excellent schools

• The Woodlands and Spring – Established luxury markets with consistent demand

• Pearland and Friendswood – Strong job growth and family-friendly amenities

• Downtown and Midtown – Urban revitalization and millennial buyer interest

Steady Growth Areas:

• Sugar Land and Missouri City – Established suburban markets

• Cypress and Northwest Houston – Affordable options with good accessibility

• Clear Lake and Seabrook – Aerospace industry proximity benefits

Investment Opportunities in Late 2025

The current market conditions present unique opportunities for real estate investors. With increased inventory and more negotiating power, investors can potentially secure properties at favorable prices before the anticipated price appreciation takes hold.

Single-Family Rental Market: Houston’s rental market continues to show strength, driven by population growth and economic diversification. Properties in suburban areas with good school districts are particularly attractive for long-term rental investments.

Fix-and-Flip Opportunities: With some motivated sellers in the market, there may be opportunities for investors looking to renovate and resell properties, especially in emerging neighborhoods.

What This Means for Buyers

If you’re planning to buy a Houston home in late 2025, the timing could work in your favor:

Advantages for Buyers:

• More inventory to choose from

• Enhanced negotiating power

• Potential for lower mortgage rates

• Sellers more willing to make concessions

Buyer Strategy Tips:

• Get pre-approved early to act quickly on good opportunities

• Consider emerging neighborhoods for better value

• Factor in potential appreciation when evaluating long-term value

• Work with experienced local agents who understand neighborhood nuances

Guidance for Sellers

Houston sellers in late 2025 need to approach the market strategically:

Key Seller Considerations:

• Price competitively based on current market conditions

• Enhance curb appeal and staging to stand out from increased inventory

• Be prepared for longer time on market compared to previous years

• Consider timing: spring 2026 may offer better selling conditions

Seller Advantages:

• Quality properties still command good prices

• New construction competition may be limited in some areas

• Underlying demand remains strong

National Trends Impacting Houston

Houston’s market doesn’t exist in isolation. National trends significantly influence local conditions:

The National Association of Realtors predicts 3% median home price growth nationally in 2025, which could provide upward pressure on Houston prices despite local market dynamics. Additionally, existing home sales are forecast to increase 6% nationally in 2025, indicating improved market activity that could benefit Houston.

This national context suggests that Houston’s more moderate growth projections may actually represent a healthy, sustainable market compared to potentially overheated markets in other major metropolitan areas.

Economic Factors Supporting Growth

Several economic indicators support the positive outlook for Houston real estate in late 2025:

Population Growth: Houston continues to attract new residents, driven by job opportunities and relatively affordable living costs compared to other major U.S. cities.

Economic Diversification: While energy remains important, Houston’s economy has diversified into healthcare, technology, aerospace, and logistics, creating a more stable job market.

Infrastructure Investment: Ongoing infrastructure projects and improvements continue to enhance neighborhood desirability and property values.

Looking Ahead: Early 2026 Predictions

While our focus is on late 2025, early indicators suggest that 2026 could bring even more positive momentum. Industry forecasts predict 4% home price growth nationally in 2026, with mortgage rates potentially declining to an average of 6.1%.

For Houston, this could mean:

• Continued steady appreciation

• Increased buyer activity as rates improve

• New construction ramping up to meet demand

• Investment activity returning to pre-2022 levels

Making Your Move in Houston’s Evolving Market

Whether you’re buying your first home, selling to upgrade, or exploring investment opportunities, Houston’s real estate market in late 2025 offers a unique window of opportunity. The combination of increased inventory, stabilizing prices, and the potential for modest appreciation creates conditions that can work for various buyer and seller situations.

Ready to navigate Houston’s real estate market? The team at Bexley Realty Group has the local expertise and market knowledge to help you make the most of current conditions. From first-time buyers to seasoned investors, we provide personalized strategies based on the latest market data and trends.

Contact us today at 832-648-2492 or visit BexleyRealtyGroup.com to discuss your real estate goals and how we can help you succeed in Houston’s evolving market.

Summary

Houston’s real estate market is positioned for gradual recovery and modest growth through late 2025. With home prices expected to appreciate nearly 2% by year-end, declining mortgage rates, and increased inventory providing buyer opportunities, the market presents a balanced environment for both buyers and sellers. The key to success lies in understanding local neighborhood dynamics, timing your moves strategically, and working with experienced professionals who can navigate the current market conditions effectively.

#HoustonRealEstate #HoustonHomePrices #RealEstateForcast #HoustonHomes #TexasRealEstate #HomeBuying #RealEstateInvestment #HoustonMarket